Transparency is a key value in the European Union. When you set up your Hungarian company and want to register for mandatory services, you are expected to present the ownership structure of the company in a transparent way. Read on to learn what that means.

Ownership structure in a chart

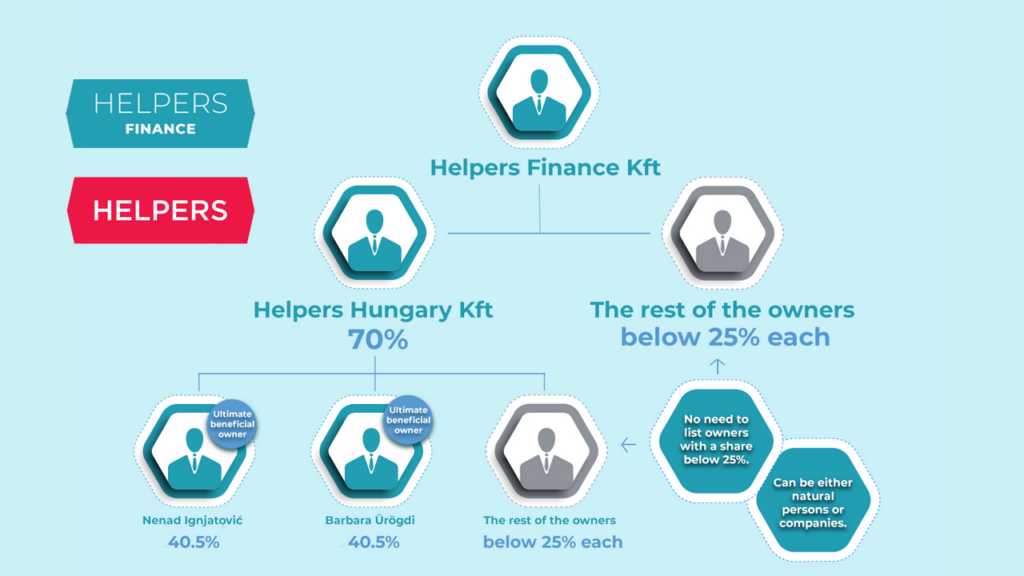

Ownership structure is easiest to present in a chart much like a family tree, as you see in the cover image of this article. The chart starts with the company, and ends with the ultimate beneficial owners: the natural persons who hold majority in the company or in its parent company.

When you are setting up a Hungarian company on your own, the ownership structure will be quite simple: just the company and you as the sole beneficial owner.

When you are setting up a subsidiary to an existing foreign company, things get more complicated.

Owners with a share of at least 25%

When you prepare the chart displaying the ownership structure of your Hungarian company, you only need to list owners with a share of at least 25%. If an owner has less than that, you can omit them. This can happen if there is a joint stock company somewhere in the family tree of your company, or simply if there are several owners.

The chart is done when each branch ends in either the name of a person or in a label saying something along the lines of “the rest of the owners; less than 25% each”.

Where to present the ownership structure?

Your Hungarian company will be required to seek some specific services to ensure compliant operation. The below service providers are required to ask for the ownership structure of your company:

- Seat address provider

- Bank

- Accountant

If your service provider is not asking for this information, they are not doing their job right, and you can expect complications further down the road.

How to present the ownership structure?

It is best to present the ownership structure of your Hungarian company in the above-mentioned family-tree like chart format. It lets you indicate layers of ownership, the owners, and the share ratios in each layer in an easily digestible format. It also makes your company look very professional (which may be important when opening your corporate bank account), while letting the clerks record your data precisely.

Please note that presenting your registration certificate or even the articles of association of the parent companies is not appropriate in these situations for the following reasons:

- The exact share ratios might not be listed, or at least not in a way the clerk can easily understand (especially if the parent company documents are not in Hungarian).

- Such documents usually provide information only up to their layer, so they might not list the ultimate beneficial owners possibly several layers removed.

- Presenting information in a way that is not readily available or easy to understand is an excellent source of clerical errors, the correction of which can cost you time and money later on.

Public and confidential information

In the EU, business ownership is considered public information. If you take a look at e-cegjegyzek.hu, which is the online database of the Hungarian Company Registry, you will see that company owners are listed by name, alongside their ID data (date of birth, mother’s maiden name, permanent address). However, the exact share ratio is not listed there, nor any information on the owners of the parent companies.

Information on the owners of parent companies is not public information, and providers are contractually obligated to treat it as confidential. They will not share it with third-parties.

Before you set up your Hungarian company, consider if any of the parent companies have ultimate beneficial owners whose identity is confidential. This might be the case with some high value companies, where the management or the subsidiary might even have an NDA in place to protect the identity of the owners. In this case, since transparency is non-negotiable, you have two options:

- Ask for the consent of these owners to share their information (preferably before the company is registered).

- Reconsider the ownership structure of your Hungarian company, and set it up with owners whose identity may be disclosed.

Reporting changes

When there is a change at any point of the ownership structure, that should be reported to the relevant providers as soon as possible. If you are not sure how to do that, consult your accountant – or if you have Helpers as your service provider, ask your account manager, and we will help you decide the best course of action.

Business setup with a professional partner

Presenting the ownership structure of your Hungarian company in a clear format makes your company look professional, while it makes setting up services with your seat provider, your accountant, and your bank a worry-free experience.

Helpers is a one-stop-shop for company setup in Hungary. We offer support not only with registration, but also with seat registration and mail forwarding, accounting, and various other services you might find relevant when starting a business in a new country. Let us help you with the paperwork, so you can focus on growing your business.

Was this article useful? Follow us on Facebook for other tips and insight on Hungarian business operation.